Content

Explain how to account for natural resources and intangible assets, including depletion and amortization. Aggregate depreciation, depletion and amortization expense in the current period for the cost of tangible assets, intangible assets, or depleting assets directly related to goods produced and sold during the reporting https://online-accounting.net/ period. Cost depletion is one of two accounting methods used to allocate the costs of extracting natural resources, such as timber, minerals, and oil, and to record those costs as operating expenses to reduce pretax income. Depletion and amortisation are two important concepts in the valuation of assets.

Is depletion a cause of depreciation?

If an asset is natural resources, such as an oil or gas reservoir, the depletion of the resource causes depreciation (in this case, it is called depletion, rather than depreciation). The pace of depletion may change if a company subsequently alters its estimate of reserves remaining.

Depreciation, Depletion and Amortization Expense Crude oil and natural gas properties. Distinguish between prepaid rent as an asset and an expense.

Change Management

Depletion refers to an accrual accounting technique commonly used in the natural resources extracting industries such as mining, petroleum, timber, among others. Accumulate amortization in both accounting and tax might have the same sum of have different sums. This is based on certain factors such as when depreciations are yet to be deducted from tax expense.

- To calculate cost depletion, you take the property basis, units total recoverable, and accounts number of units sold.

- National Tax Training School was founded in 1952 and over the past 60+ years has grown into the most recognized and respected distance learning institution dedicated to training its students in US federal taxation.

- Different countries have different laws and regulations for calculating depreciation.

- On the other hand, depletion is an accrual accounting technique that is used to quantify the cost of taking natural resources from the ground, such as lumber, oils, minerals, and other types of minerals.

- Foreign exchange risk has been high on the agenda of CFOs of MNCs for many years.

- Tangible assets begin amortization on their date of entry.

The word depletion is used when natural resources such as lumber, oil, coal, and lead are involved. Amortization is the term used to describe the process of intangible assets such as patents or copyrights expiring. In accounting, depreciation and amortization are used to allocate, or expense, the cost of an asset over its useful life, or the length of time the asset will be used by the organization. While the terms “depreciation” and “amortization” describe the same accounting process — cost allocation across time — depreciation is often used when referring to tangible assets, while amortization often refers to intangible assets.

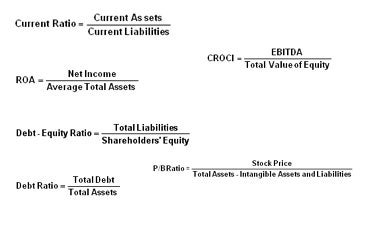

Making Something out of Nothing: Business Interruption Claims and the Start-up Enterprise

Depreciation relates to the cost of a tangible asset, depletion to the cost of extracting natural resources, and amortization to the deduction of an intangible asset. Amortisation is the process of spreading the expense of an intangible asset over the asset’s useful life. It is a representation of the asset’s consumption over the course of its useful life. Because the cost of an intangible asset cannot be attributed in one lump sum, it must be spread out over the asset’s useful life to deduct the expense amounts from income taxes. An example is the depreciation of the component parts of a mill including the crusher, ball mills, SAG mill, roasters, building and all the ancillary equipment and conveyors. Often, a miner will record depreciation on these assets based on the expected useful life based on volume, which is typically referred to as “units of production” .

There is no set length of time am intangible asset can amortize it could be for a few years to 30 years. The value of an asset should decrease throughout its useful life.

Horngren’S Financial And Managerial Accounting

Enterprises with an economic interest in mineral property or standing timber may recognize depletion expenses against those assets as they are used. Depletion can be calculated on a cost or percentage basis, and businesses generally must use whichever provides the larger deduction for tax purposes.

- These rankings represent 25% and 17% increases from last year.

- Harold Averkamp has worked as a university accounting instructor, accountant, and consultant for more than 25 years.

- The rights can also be amortized over the volume produced where the mineral reserve size is known and the annual amortization would vary directly with the volume produced.

- Helstrom attended Southern Illinois University at Carbondale and has her Bachelor of Science in accounting.

- Depreciation, depletion and amortization are also described as noncash expenses, since there is no cash outlay in the years that the expense is reported on the income statement.

- While the terms “depreciation” and “amortization” describe the same accounting process — cost allocation across time — depreciation is often used when referring to tangible assets, while amortization often refers to intangible assets.

- At the grocery store, you give up cash to get groceries.

Briefly explain the differences between the terms, depreciation, depletion, and amortization. Percentage technique is one of the many methods Depreciation, Depletion, Amortization used to calculate expenses related to depletion. It works by assigning a fixed percentage to gross income to allocate expenses.