Content

- Gross Profit Margin Explained

- Wholesale Profit Margin Calculator Results

- The net profit margin formula

- Gross profit margin vs net profit margin: What’s the difference?

- What Is a Good Net Profit Margin?

- What Does the Gross Profit Margin Tell You?

- Whether the business is successfully converting revenue into profit

While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service. The result of these calculations is displayed in percentages, but you may also express them in decimal form (e.g., 13% becomes 0.13). Note that the net profit margin ratio is not the same as [profit margin of the business you’re trying to analyze. There may be a good reason for the increase, but you will want to know where, how, and why that money is being made. The profit margin calculator is a free tool Shopify offers to businesses. Profit margin can be a good indicator of a company’s financial performance, but it is only one of several indicators and should be used alongside other metrics such as return on equity and return on assets.

To calculate gross profit margin, start by subtracting the cost of goods sold from the net sales. Then, divide the difference by the net sales to find the gross profit margin. If you’re not sure what the net sales and cost of goods sold are, you can look them up on the company’s income statement. Gross profit margin shows how efficiently a company is running.

Gross Profit Margin Explained

Margin trading is the practice of using borrowed funds from brokers to trade financial assets; this essentially means investing with borrowed money. Usually, there is collateral involved, such as stocks or other financial assets of value. Calculate the minimum amount to maintain in the margin account to make currency trading.

- If you’re using the wrong credit or debit card, it could be costing you serious money.

- Most of the time people come here from Google after having searched for different keywords.

- You may find it easier to calculate your gross profit margin using computer software.

- Investors look at mainly net profit margin along with gross margin.

- The net profit margin reflects a company’s overall ability to turn income into profit.

As a business owner, it’s important for you to understand how to calculate your profit margin. However, it’s just as important to understand what those results really mean. The Ascent is a Motley Fool service that rates and reviews essential products for your everyday money matters. Let’s say that your business took $400,000 in sales revenue last year, plus $40,000 from an investment.

Wholesale Profit Margin Calculator Results

Let us understand the concept of finding gross profit percentage with the help of a couple of examples. Return on equity is a measure of financial performance calculated by dividing net income by shareholders’ equity. Abbreviated COGS, this figure includes the cost of materials, labor, and other expenses directly related to the production of goods or services.

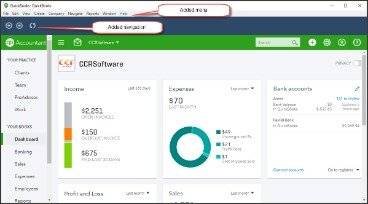

After clicking “calculate”, the tool will run those numbers through its profit margin formula to find the final price you should charge your customers. Shopify’s easy-to-use profit margin calculator can help you find a profitable selling price for your product. The Gross Profit Margin Calculator will instantly calculate the gross profit margin of any company if you simply enter in the company’s sales and the company’s cost of goods sold . You may find it easier to calculate your gross profit margin using computer software. Before you sit down at the computer to calculate your profit, you’ll need some basic information, including revenue and the cost of goods sold.

The net profit margin formula

Use the gross profit margin formula to calculate gross profit margin. To calculate your operating profit margin, take your operating income and divide it by your sales revenue. Use this margin calculator to work out the gross margin, sales margin or net profit margin for your product or business.

- The Balance uses only high-quality sources, including peer-reviewed studies, to support the facts within our articles.

- For gross profit, gross margin percentage and mark up percentage, see the Margin Calculator.

- It is important that the companies being compared are fairly similar in terms of size and industry.

- Specialties include general financial planning, career development, lending, retirement, tax preparation, and credit.

- It can also be useful for more experienced traders who want to fine-tune their portfolios and manage their risks effectively.

- As you can see, margin is a simple percentage calculation, but, as opposed to markup, it’s based on revenue, not on Cost of Goods Sold .

Other options include looking for new suppliers, dropping customers who are no longer profitable, and looking for other ways to streamline services. Industry wide, a profit margin of 10% is considered average, while a good profit margin is 20% or higher. We’re firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team. If you’re using the wrong credit or debit card, it could be costing you serious money.

Gross profit margin vs net profit margin: What’s the difference?

Weakness at these levels indicates that money is being lost on basic operations, leaving little revenue for debt repayments and taxes. The healthy gross and operating profit margins in the above example enabled Starbucks to maintain decent profits while still meeting all of its other financial obligations. To calculate your net profit margin, take your total revenue figure and deduct your total expenses to get your net income figure. For a more in-depth explanation of this, see ourarticle about the profit margin formula. By using the margin calculators, you can get a gauge of the profitability of a business and, specifically, how well it turns its revenue into profit.

Our experts love this top pick, which features a 0% intro APR until 2024, an insane cash back rate of up to 5%, and all somehow for no annual fee. Only add direct labor costs, such as employees on an assembly line. One of the most important small business accounting tasks any small business owner should be doing is using various calculations that provide insight into how your business is performing financially. Net margin is $100k of net income divided by $700k of revenue, which equals 14.3%.

It does not Gross Profit Margin Calculator any other expenses except the cost of goods sold. However, each formula has its own value for internal analysis. The gross profit margin can be used by management on a per-unit or per-product basis to identify successful vs. unsuccessful product lines.

How to Calculate Profit Margin (Formula + Examples) – The Motley Fool

How to Calculate Profit Margin (Formula + Examples).

Posted: Wed, 18 May 2022 07:00:00 GMT [source]